WE SHOULD ALL BE MILLIONAIRES

Let us show you how to make seven-figures.

Welcome to Hello Seven.

Take The Hello Seven Growth Scale Assessment to diagnose your biggest problem in business and find out how to solve it.

WHAT WE DO

At Hello Seven, we teach women how to build wealth.

We provide business training, legal services, and money mindset coaching to help you achieve your financial goals.

We want you to have so much money, you never have to worry about money again.

WHY WE DO IT

We want to build a world where women hold serious financial power.

The power to purchase a home, save for retirement, send your child to the best schools, fund progressive causes, transform your community, and anything else you want to do.

For too long, women have worked twice as hard to earn less than men, and women have felt emotionally broke and financially stressed.

At Hello Seven, we are determined to change this. It’s time for women—especially women of color—to make bank.

Why We Do This Work

Listen to the Podcast

The Hello Seven Podcast is like going to Money Church and listening to a sermon that lights your heart on fire. New episodes drop weekly. You need this in your life.

HANG WITH US

When you hang out with successful, ambitious women, the golden-money-dust rubs off on you! Roll with us and get million dollar ideas for free.

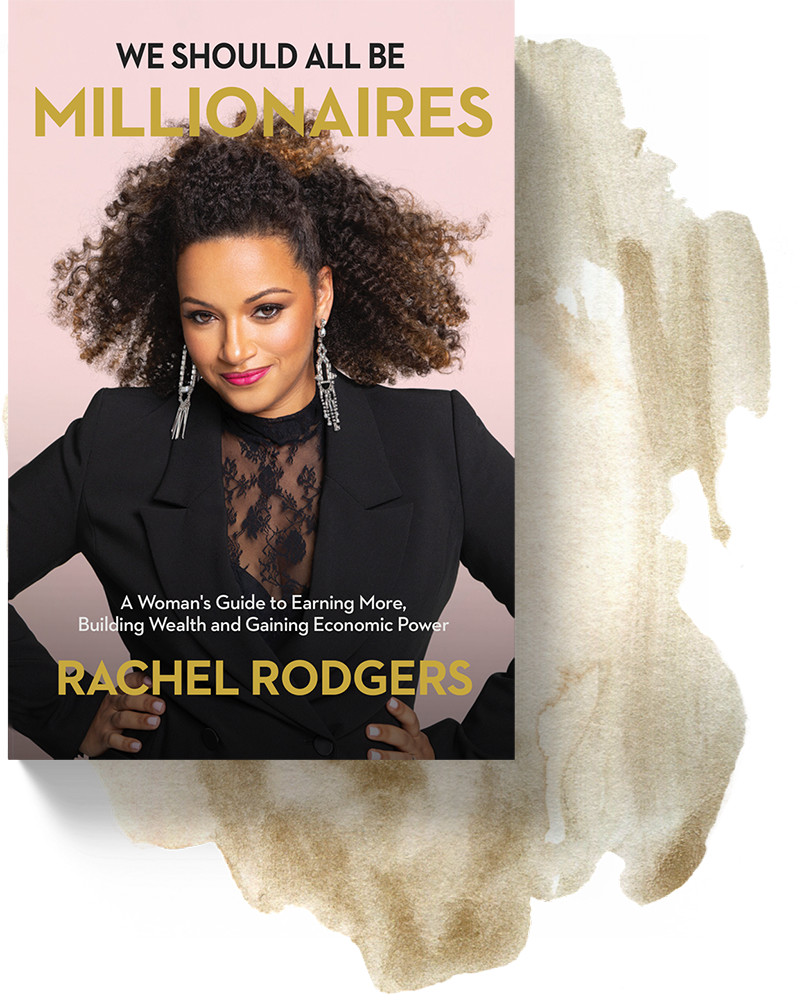

GET THE BOOK

We Should All Be Millionaires is out now!

It’s time to stop making broke-ass decisions and start making million dollar decisions. This book shows the way.

Business strategy is not one-size-fits-all.

The Hello Seven Growth Scale Framework identifies where you

fall on one of seven levels — from $0 to 7 figures — and lays out

the specific action steps you need to take to grow from one level

to the next.

What level are you at? And what does that mean for you and the

future of your business?